<Is John Deere (DE) the Best Agriculture Stock to Buy in 2025?>

Hey there, folks! If you’re on the hunt for the best agriculture stocks to buy in 2025, you’ve probably stumbled across John Deere (ticker: DE). You know, the green tractor giant that’s been popping up everywhere lately. With U.S. agriculture stocks heating up—especially ones tied to Trump’s policies—I couldn’t help but wonder: is John Deere really the top dog among agriculture stocks to invest in? I’ve been digging into this one, pulling from my own stock-watching adventures, and here’s what I found. Let’s break it down!

Fundamental analysis

The Heavyweight Champ of Farm Equipment

When it comes to farm gear, John Deere isn’t just playing—it’s dominating. They’ve locked down the No. 1 spot globally for tractors and harvesters, with a market share of 25-30%. I got curious about agriculture stocks to invest in last year and learned that for North American farmers, John Deere is basically the go-to name. Competitors like CNH Industrial or AGCO? Solid, but they’re nowhere near Deere’s $55 billion revenue haul in 2024. If you’re doing a John Deere stock analysis, this kind of muscle screams “leader” in the farm equipment game—maybe even the best agriculture stock for 2025 in that niche.

Tech That Makes It a Farming Game-Changer

What really sets John Deere apart, though, isn’t just tractors—it’s their tech. They’re rolling out self-driving machines and AI tools that are turning heads. I saw their autonomous 8R tractor at CES a while back and thought, “This could be one of the top farming technology stocks out there.” Picture fields getting plowed with no farmer in sight—that’s the future they’re building. Their Operations Center platform ties it all together, helping farmers crunch data for smarter decisions. For anyone eyeing agriculture stocks to invest in, this tech edge makes John Deere a standout contender for 2025 and beyond.

Brand Muscle and Investor Goodies

Let’s talk numbers—because that’s where this stock shines in any John Deere stock analysis. As of February 2025, their market cap’s around $140 billion, dwarfing peers like ADM ($25 billion) or Corteva ($39 billion). The stock’s hovering near $500, up nearly 3x over five years, showing investors are all in. Plus, you get a decent dividend—about $5.88 a year, or a 1.5% yield—which is nice for a long-term hold. I’ve tossed similar names into my portfolio before, and it’s always reassuring to have a solid pick like this. Could it be the best agriculture stock to buy in 2025 for both growth and income? It’s definitely in the running.

A Boost from Trump’s Playbook

Here’s where it gets interesting: Trump’s back, and his “America First” push could make John Deere one of those hot Trump policy stocks. With a focus on U.S. manufacturing and farm support, think tariffs on foreign gear and bigger subsidies for farmers. That’s a recipe for more demand for Deere’s machines. I’ve always felt agriculture stocks to invest in with policy tailwinds are better for a patient play than a quick flip, and John Deere fits that vibe perfectly. It’s got that extra nudge that might seal its spot as a top pick for 2025.

How It Stacks Up in the Agri World

Now, let’s zoom out. Is John Deere the king of all agriculture stocks? Not quite. Farming’s a big field—seeds, chemicals, grain trading, you name it. Corteva and Bayer rule the seed and pesticide game, while ADM and Bunge crush it in grains. And Cargill, a private giant, looms large too. So, while John Deere might top the charts for machinery and farming technology stocks, it’s more like one of the best agriculture stocks for 2025 rather than the only one. Still, in its lane, it’s untouchable.

So, Is It Worth Your Money in 2025?

Alright, real talk: would I bet on John Deere as one of the best agriculture stocks to buy in 2025? After kicking the tires, I’d say heck yeah. It’s got cutting-edge tech, a monster brand, a hefty market cap, and policy winds in its favor—plenty of room to grow too. Sure, grain prices or weather could shake things up (I’ve been burned on agri-stocks before!), but Deere’s built to handle it. I’d play this one long rather than short. What’s your take? Is John Deere your pick for the best agriculture stock in 2025, or are you scouting other gems? Hit me up in the comments—I’m curious! What stock should I tackle next?

Technical analysis

1. Current Price and Trend

- The current stock price, as of February 21, 2025, closed at $489.98, after hitting a recent high of $494.94 and easing overbought conditions in what looks like a healthy organic correction. While the price has dropped below the upward trendline, it doesn’t mean the bullish trend is dead or heading downward. The pullback started at the 0.236 Fibonacci level ($488.20) and has partially recovered, but in my personal opinion, I feel there might still be some more downside left. I don’t think the overbought zone is fully cleared yet, and it seems like there’s room for more adjustment.

2. MACD (Moving Average Convergence Divergence)

- The MACD line is below the signal line in negative territory, indicating bearish momentum. It was trending down as if it might resolve, but a sharp rally pulled the price up again, and that strong bounce makes the correction seem pretty significant. The histogram is red, but the risk of further decline remains until the MACD crosses above the signal line. I notice the MACD gap is finally starting to narrow, so I’m cautiously hopeful about a potential bounce—but I’m not confident just yet. I think I’ll need to watch this indicator a bit longer.

3. RSI (Relative Strength Index)

- The RSI is in a neutral state, neither overbought nor oversold. But honestly, with such a strong volume-driven rally, I’m a bit skeptical about whether a big drop will follow. I think it’s wise to keep in mind the possibility of sideways movement as it recovers into the neutral zone. It’s trying to bounce back after the recent decline, but the direction is still unclear.

4. Volume

- Volume spiked during the price drop, but it’s now below average, suggesting a potential decrease in volatility. Still, volume remains solid, so I don’t think market interest has completely faded. Personally, I’m keeping an eye on this volume trend, hoping it might signal a trend reversal.

5. Moving Averages (EMA)

- The stock is below its short-term EMA (50-day) and far from its long-term EMA (200-day), signaling bearish momentum. The downward crossover between the short-term and long-term lines warns of potential further declines. It feels like there’s still room for more correction, in my view.

6. Fibonacci Retracement and Support/Resistance

- After pulling back from the 0.236 level ($488.20), the price has seen some recovery, but I think it’s worth considering a dip to the 0.382 level ($471.74) before bouncing back. The current price of $489.98 is in a neutral zone after the correction started from the upper Fibonacci levels, and I’m still deciding on direction. If it drops to that level, I feel there could be a bigger correction coming.

Overall Technical Analysis Conclusion

- Short-Term Outlook: John Deere’s stock appears to be undergoing a healthy organic correction after its recent high of $494.94. The overbought zone hasn’t fully cleared, so more adjustment seems possible. While the MACD gap is narrowing, there’s still a risk of decline if support breaks, and I’d keep the 0.382 level ($471.74) in mind as a potential target for further correction.

Comprehensive Evaluation

Fundamental Analysis: A Market Leader in Agricultural Machinery – Growth and Challenges

John Deere holds the No. 1 position in the global agricultural machinery market, with a 25–30% market share and $5.5 billion in sales recorded in 2024—significantly outperforming competitors like CNH Industrial and AGCO. The company is also a frontrunner in digital agriculture, leading the way in autonomous tractors and AI technology. Furthermore, the “America First” policy under Trump (tariffs and agricultural subsidies) is expected to provide additional benefits.

The company’s market capitalization remains stable at $140 billion, with a dividend yield of 1.5% ($5.88 per share).

However, short-term challenges persist due to high-interest rates and declining crop prices. Despite these challenges, long-term growth prospects remain strong.

Technical Analysis: In a Correction Phase, but Still Holds Buying Potential

On February 21, 2025, John Deere closed at $489.98, experiencing a healthy pullback from its recent high of $494.94. The ongoing correction, which started at the 0.236 Fibonacci retracement level ($488.20), may extend further between the 0.618 level ($481.14) and the 0.786 level ($461.19). However, key support levels have not yet been decisively tested.

I personally anticipate a potential retracement to the 0.382 level ($471.74). Here’s a look at the key indicators:

- MACD: Weak but narrowing gap (potential for recovery).

- RSI: Neutral (hovering around 50–55).

- Trading Volume: Strong but slightly decreasing.

- EMA: Short-term downtrend, with a bearish crossover.

Comprehensive Conclusion: What Is the Investment Strategy?

John Deere maintains a strong market position in agricultural machinery and technology. It remains a solid long-term investment thanks to policy benefits and an attractive dividend yield.

However, in the short term, the company’s earnings and stock price are undergoing a correction. The best entry opportunity may arise if MACD and RSI show signs of reversal alongside an increase in trading volume.

Recommended Buy Price: Around $475(Of course, it’s my personal opinion)

steel Best Agriculture Stock to Buy in 2025?

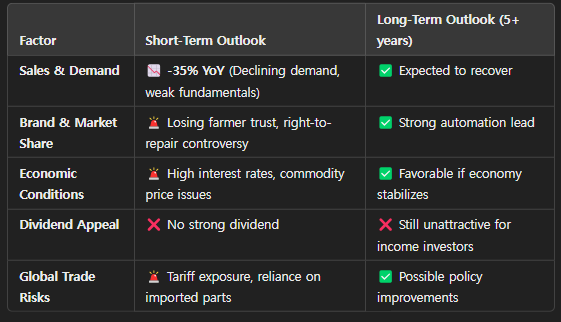

Actual Holders’ Opinions

fundamental analysis

DE’s fundamentals are solid, but the short-term outlook is rough.Net sales are down 35% YoY, leading to production cuts across all segments.The company dominates US agriculture (75% of domestic sales from US manufacturing).Tech investments (e.g., See & Spray Ultimate system, ExactEmerge planting tech) are benefiting farmers.

Concerns:

- Commodity prices and interest rates are hurting demand → 20-25% sales decline in agricultural sectors, 10-15% in construction.

- Cyclical stock → Need fundamental improvements before investing.

- Dividend is safe ($7B cash, strong free cash flow).

Brand image

Brand recognition remains strong, butPerceived as too expensive and complex → HarderLeading in automation →International concerns:

- High reliance on imported parts → **Tariff risks.

- Soybean exports to China → May hurt

- Industry is heavily subsidized,

Short-term outlook: UnLong-term (5+ years): Promising.

Concerns About Reputation & Customer Trust

- Losing trust among American farmers at a **faster rate.

- Brand damage from

- Plant closures & layoffs (moving

- “Right to repair” controversy → Google it for

- Recommendation: **Avoid DEAvoid DE short term.

“Right to repair” controversy

John Deere and the “Right to Repair” Controversy (Summary)

Key Points:

- John Deere restricts farmers from independently repairing or accessing parts for tractors and farm equipment by using software (DRM), limiting repairs to authorized dealerships. This results in high costs (e.g., $600 for a 3-minute job) and long wait times, drawing criticism.

- Since 2017, farmers, advocacy groups, and some states have pushed for “Right to Repair” legislation. In 2023, John Deere signed an MOU with the American Farm Bureau Federation (AFBF) to allow access to software, manuals, and tools, but it lacks legal binding and could be withdrawn if laws pass. In January 2025, the FTC, Illinois, and Minnesota filed a lawsuit against John Deere for antitrust violations.

- John Deere defends its restrictions citing safety and intellectual property concerns, while expanding a pilot program for repairs.

Market Reactions:

- Farmers express frustration over costs and inconvenience, shifting to competitors (e.g., Kubota, CNH). Criticism on X labels John Deere as “greedy.”

- The market and investors worry about declining brand trust, falling sales, and legal/financial risks from the FTC lawsuit. Long-term market share loss is anticipated.

Conclusion: The controversy persists, with John Deere attempting responses but lacking a full resolution, potentially facing ongoing damage.

Comprehensive contents of AI

new general opinion

still Best Agriculture Stock to Buy in 2025?

DE is likely to show a consistent upward trend in the chart, but consequently, it can be seen that it is currently heavily damaged in its corporate image. In fact, the results of receiving opinions on Reddit were criticized for its continued decline in trust and unfriendly attitude.

In the meantime, there seems to be no problem with dividends due to massive cash reserves, but if you check AI analysis at the same time, I wonder if I should buy other good stocks. There are many companies with excellent long-term future vision

In the end, it is judged that it is not a stock with a buying advantage

I used AI to check and approach technical indicators, but I think I came to a good conclusion that I should comprehensively reflect the opinions of actual holders in the market. I wonder what those of you who actually have an opinion on this stock think

1kcjjg

6v9vu7

2inwx7